ADVI Instant: CMS Releases 2025 Physician Fee Schedule and Proposed Rule

On July 10, 2024, the Centers for Medicare and Medicaid Services (CMS) issued the 2025 Medicare Physician Fee Schedule (PFS) proposed rule and other revisions to payment policies under Medicare Part B (link) with an accompanying fact sheet (link).

Notably, this year’s PFS Proposed Rule includes a proposed 2.80 percent rate decrease, compared to the CY 2024 final payment rate, as well as proposed policies for the Inflation Reduction Act (IRA) Medicare Prescription Drug Inflation Rebate Program. The rule also contains proposals to determine payment limits for negative or zero manufacturer’s ASP data, establish a fee schedule for Drugs Covered as Additional Preventive Services, and update policies for colorectal cancer screening.

Comments are due on September 9, 2024.

Below, ADVI provides an overview of the proposed rule. Please contact your ADVI Account Manager for additional details.

Conversion Factor Update and Rate Setting Impact

The proposed conversion factor for CY 2025 is $32.36, a $0.93 decrease (or 2.80 percent decrease) from $33.29 in CY 2024.

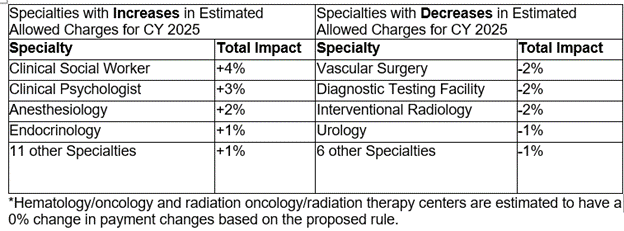

Table 128 includes a breakdown by specialty of estimated payment changes based on the proposed rule:

Medicare Prescription Drug Inflation Rebate Program

- CMS proposes to codify policies previously established in guidance for the Medicare Prescription Drug Inflation Rebate Program (Part B Inflation Rebate Revised Guidance (link), Part D Inflation Rebate Revised Guidance (link)).

- Unless otherwise specified, CMS proposes that the provisions herein would apply, with respect to Part B rebatable drugs, for all calendar quarters beginning with January 1, 2023, and with respect to Part D rebatable drugs, for all applicable periods beginning with October 1, 2022 (i.e., the first established rebate periods)

- CMS proposes the following ‘new’ policies, some of which were detailed in the revised guidances with the intention to address in this rulemaking

- For Part B Inflation Rebates, CMS proposes to:

- Compare the payment amount in the quarterly pricing files published by CMS to the inflation-adjusted payment amount for a given quarter when determining whether the criteria for a coinsurance adjustment are met.

- Use a payment amount benchmark quarter of the third full calendar quarter after the drug’s first marketed date for a Part B rebatable drug first approved/licensed on or before December 1, 2020 but with a first marketed date after such date.

- For a Part B rebatable drug that was billed under a NOC code during the calendar quarter beginning July 1, 2021, or the third full calendar quarter after such drug’s first marketed date, whichever is later, the payment amount benchmark quarter is the third full calendar quarter after the drug is assigned a billing and payment code other than a NOC code.

- Remove 340B units for professional claims with dates of service during 2024 (in addition to 2023) submitted by Medicare suppliers that are listed by the Health Resources and Services Administration (HRSA) 340B Office of Pharmacy Affairs Information System as participating in the 340B Program, by using National Provider Identifiers and/or Medicare Provider numbers to identify these suppliers and the claims submitted with such identifiers. (Note: CMS previously planned to rely on modifiers for 2024 exclusions)

- Remove units of refundable single-dose container or single-use package drugs subject to discarded drug refunds, from the calculation of rebate amounts, generally in the reconciliation process.

- Perform one reconciliation of rebate amounts within 12 months of sending Rebate Reports if CMS identifies any agency errors in calculation or manufacturer misreporting.

- Enforce civil money penalties on manufacturers that fail to pay rebate amounts equal to 125 percent of the rebate amount.

- For Part D Inflation Rebates, CMS proposes to:

- Use a payment amount benchmark period of the first calendar year (no earlier than CY2021) in which the drug has at least one quarter of AMP reported for Part D Rebatable drugs first approved/licensed on or before October 1, 2021 but without AMP data reported between January 1, 2021 and September 30, 2021.

- For subsequently approved drugs (after October 1, 2021) without AMP data in the first CY after the drug’s first marketed date, the payment amount benchmark period would be the first calendar year in which such drug has at least 1 quarter of AMP reported.

- CMS is soliciting comments on alternative policies to address certain instances in which AMP are not reported for certain NDC-9s of a Part D rebatable drug.

- Begin excluding 340B drugs from Part D rebate calculations for claims with dates of service on or after January 1, 2026.

- CMS plans to use data reflecting the total number of units of a Part D rebatable drug for which a discount was provided under the 340B Program and that were dispensed during the applicable period to determine the total number of units to exclude.

- CMS notes it may apply adjustment(s) to these data as needed and is soliciting comments on alternative policies for collecting and using 340B data to calculate rebate amounts for Part D rebatable drugs.

- Perform one reconciliation of rebate amounts within 12 months of sending Rebate Reports if CMS identifies any agency errors in calculation or manufacturer misreporting, and a second reconciliation approximately 24 months thereafter.

- Enforce civil money penalties on manufacturers that fail to pay rebate amounts equal to 125 percent of the rebate amount.

- CMS also notes that if any provision of proposed part 427 (Part B inflation rebates) or part 428 (Part D inflation rebates) were to be invalidated, they would be considered severable and the remaining sections would remain valid and enforceable.

Part B Drug-Related Proposals

Requiring Manufacturers of Certain Single-Dose Container or Single-Use Package Drugs to Provide Refunds for Discarded Amounts:

- Increased Applicable Percentage

- In the CY 2024 PFS final rule, CMS finalized an application process for increasing the applicable percentage otherwise applicable for determining the refund.

- CMS received one application for increased applicable percentage for CY 2025 for Leukine. After review, CMS is not proposing an increase in the applicable percentage for the drug.

- Clarifying Definitions

- Under current policy, if a drug has been paid under Part B for under 18 months, it is exempt from the definition of “refundable drug.”

- CMS is clarifying that the first date for which the drug is actually paid under Part B (not the date of first sale) would be used to determine the beginning of the 18-month exclusion period.

- This clarification is only applicable to drugs for which the date of first sale as reported to CMS does not adequately approximate the first date of payment under Part B due to an applicable National Coverage Determination (NCD).

- CMS proposes to include the following drugs in the definition of “refundable single-dose container or single-use package drugs.”

- Injectable drugs with a labeled volume of 2mL or less, even when lacking package type terms and explicit discard statements in product labeling.

- Drugs contained in ampules (airtight vials) for which there is no discard statement or language indicating the package type term.

- Discarded Amounts

- CMS proposes to require the JW modifier if a billing supplier is not administering a drug, but there are amounts discarded during the preparation process before supplying the drug to the patient. The supplier would report the JZ modifier if no amounts were discarded during the preparation process.

Payment Limits for Negative or Zero ASP Data:

- CMS notes that manufacturers can report that an NDC has a negative or zero-dollar value for the manufacturer’s ASP with a positive, negative, or zero number of units sold. Similarly, manufacturers can report a positive dollar value for the ASP with a negative or zero number of units sold. These above scenarios are referred to as “negative or zero manufacturer’s ASP data.”

- Negative or zero manufacturer’s ASP data could occur because of lagged discounts, units returned to the manufacturer, drug shortages, or drug discontinuations.

- In these scenarios, when the reported ASP for at least one NDC within the billing and payment (HCPCS) code of the drug is negative or zero, CMS proposes to consider ASP data to be “not available” for the purposes of calculating a payment limit.

- CMS proposes the following to calculate payment limits when provided with negative or zero ASP data:

- Single source (including biosimilars) and multiple source drugs when negative or zero manufacturer’s ASP data is reported for some, but not all, NDCs: Calculating a payment limit using only NDCs with positive manufacturer’s ASP data.

- Multiple source drugs with only negative or zero manufacturer’s ASP data: Using data from the most recent calendar quarter for which data is available to calculate the payment limit.

- Single source drugs with only negative or zero manufacturer’s ASP data, excluding biosimilars: Using the lesser of:

- 106 percent of the volume-weighted average of the most recent available positive manufacturer’s ASP data from a previous quarter, or

- 106 percent of the WAC for the given quarter.

- Biosimilars with only negative or zero manufacturer’s ASP data: Using the volume-weighted average of the positive manufacturer’s ASP data from all other biosimilars with the same reference product plus six percent (or eight percent for qualifying biosimilars) of the reference biological product.

- If there are no other biosimilars with the same reference product, CMS will use the volume-weighted average of the most recent available positive manufacturer’s ASP data plus six (or eight) percent of the reference biological product.

Hepatitis B Vaccinations:

- Under current policy, Medicare beneficiaries who are at high or intermediate risk of contracting hepatitis B can receive the hepatitis B vaccines with no cost to the beneficiary.

- CMS proposes to expand the list of individuals who are at high or intermediate risk of contracting hepatitis B to include individuals who have not previously received a completed hepatitis B vaccination series or whose vaccination history is unknown.

Drugs Covered as Additional Preventive Services (DCAPS drugs):

- CMS notes that while they have not covered or paid for any drugs or biologicals under the benefit category of additional preventive services, they acknowledge the forthcoming NCD decision on coverage of PrEP under Part B. As such, CMS proposes outlining payment for drugs covered as additional preventative services.

- Proposed Fee Schedule

- CMS proposes to establish a DCAPS fee schedule, using the following:

- CMS proposes to use the ASP methodology described in section 1847A of the Act to determine the payment limit for a DCAPS drug under the fee schedule; this is usually 106% of ASP.

- If ASP data is not available, CMS proposes to determine the payment limit using the most recently published amount for the drug in Medicaid’s National Average Drug Acquisition Cost (NADAC) survey. CMS would use the billing unit, which is an average of NADAC prices for all NDCs for the drug.

- If both ASP and NADAC pricing data are not available, CMS proposes to use the most recently published and listed prices for pharmaceutical products in the Federal Supply Schedule (FSS). CMS would calculate the average price per billing unit for all NDCs listed for a drug.

- If ASP, NADAC, and FSS prices are not available, CMS proposes to use the invoice price determined by MACs.

- Supplying and Administration of Drugs

- CMS proposes administration and supplying fees for DCAPS drugs that mirror existing policies under the PFS and Part B drug payment.

- For drugs supplied by a pharmacy, CMS proposes the following supplying fees to pharmacies:

- $24 for the first DCAPS prescription supplied to a beneficiary in a 30-day period, and

- $16 for all subsequent DCAPS prescriptions supplied to a beneficiary in that 30-day period.

- For physician administered drugs, CMS proposes to crosswalk the administration fee to an existing, corresponding drug administration code under the PFS.

- CMS notes that in the Proposed NCD for PrEP, they propose national rates for HCPCS code G0012 (Injection of pre-exposure prophylaxis (PrEP) drug for HIV prevention, under skin or into muscle) that are crosswalked from CPT code 96372 (Therapeutic, prophylactic, or diagnostic injection (specify substance or drug); subcutaneous or intramuscular).

- Because administration or supplying would be considered an additional preventive service, no cost sharing would apply.

- CMS proposes to apply the above payment policies to DCAPS drugs furnished in Rural Health Clinics (RHCs) or Federally Qualified Health Centers (FQHCs).

Payment of Radiopharmaceuticals:

- CMS proposes to codify that, for radiopharmaceuticals furnished in a physician’s office, MACs can determine payment limits using any methodology that was in place on or prior to November 2003 (prior to the passage of the Medicare Prescription Drug, Improvement, and Modernization Act of 2023, or MMA).

Immunosuppressive Therapy:

- CMS proposes to include orally and enterally administered compounded formulations of immunosuppressive drugs in the immunosuppressive drug benefit.

- CMS proposes to update the furnishing fee regulations to clarify that blood clotting factors must be self-administered to be eligible for the clotting factor furnishing fee, and that entities who furnish clotting factor are paid through another system (e.g., during an inpatient stay or in the outpatient setting).

- CMS notes that gene therapies for hemophilia are not eligible for a clotting factor furnishing fee because they are physician administered drugs.

Colorectal Cancer (CRC) Screening

CMS proposes to update and expand coverage for colorectal cancer screening by:

- Removing coverage for the barium enema procedure.

- Adding coverage for the computed tomography colonography (CTC) procedure.

- Expanding a “complete colorectal cancer screening” to include a follow-on screening colonoscopy after a Medicare covered blood-based biomarker CRC screening test (described and authorized in NCD 210.3).

- CMS proposes to add the following services to the Medicare Telehealth Service List on a provisional basis for CY 2025:

- Home International Normalized Ratio (INR) Monitoring

- Caregiver Training services

- CMS proposes one service for the permanent addition to the Medicare Telehealth Services List:

- CMS plans to review all provisional codes currently on the Medicare Telehealth Services List before determining which codes should be made permanent.

- CMS proposes revisions to existing regulations to clarify that an interactive telecommunications system may include two-way, real-time audio-only communication technology for any telehealth service furnished to a beneficiary in their home if the distant site physician or practitioner is technically capable of using audio and video equipment permitting two-way, real-time interactive communication, but the patient is not capable of, or does not consent to, the use of video technology.

- CMS proposes to extend the definition of “Direct Supervision” to include audio-video communications technology through 2025, and permanently define “Direct Supervision” to include audio-video communications technology for a subset of services.

- CMS proposes to permit the distant site practitioner to use their currently enrolled practice location instead of their home address when providing telehealth services from their home through the end of CY 2025.

- For CY 2025, CMS proposes updating the Telehealth originating site facility fee to $31.04.

Evaluation and Management (E/M) Services

Office/Outpatient (O/O) E/M Visits

- For CY 2025, CMS proposes to allow payment of the O/O E/M visit complexity add-on code G2211 when the O/O E/M base code is reported by the same practitioner as an annual wellness visit, vaccine administration, or any Part B preventive service furnished in an office or outpatient setting.

Hospital Inpatient or Observation (I/O) Evaluation and Management (E/M) Add-on for Infectious Diseases

- For CY 2025, CMS proposes a new HCPCS add-on code (GIDXX) to describe the intensity and complexity inherent to I/O care with a confirmed or suspected infectious disease.

Quality Payment Program (QPP)

CMS proposes several changes starting January 1, 2025, related to the QPP. Specifically, CMS proposes:

- Creating six new Merit-based Incentive Programs (MIPS) Value Pathways (MVPs) around Complete Ophthalmologic Care, Dermatological Care, Gastroenterology Care, Optimal Care for Patients with Urologic Conditions, Pulmonology Care and Surgical Care.

- Modifying certain MVP scoring policies to align with traditional MIPS policies.

- Creating an APM Performance Pathway (APP) Plus quality measure set to align with the Universal Foundation measures under the CMS National Quality Strategy. This quality measure set would be established as a second, optional measure set with the existing APP quality measure set.

- Updating traditional MIPS performance category measures and activities, including the quality performance category, cost performance category, and improvement activities performance category.

CMS also issues a Request for Information on the design of a potential ambulatory specialty care model that would leverage MVPs to increase the engagement of specialists in value-based care and expand incentives for primary and specialty care coordination.

Clinical Laboratory Fee Schedule (CLFS)

- CMS proposes to revise the definitions of both the “data collection period” and “data reporting period” to specify that for the data reporting period of January 1, 2025, through March 31, 2025, the data collection period is January 1, 2019, through June 30, 2019.

- CMS proposes to indicate that initially, data reporting begins January 1, 2017, and is required every 3 years beginning January 2025.

- CMS proposes to indicate that for CY 2024, payment may not be reduced by more than 0.0 percent as compared to the amount established for CY 2023, and for CYs 2025 through 2027, payment may not be reduced by more than 15 percent as compared to the amount established for the preceding year.

- CMS notes that under current law, the CLFS payment rates for CY 2026 through CY 2028 will be based on applicable information collected during the data collection period of January 1, 2019 through June 30, 2019, and reported to CMS during the data reporting period of January 1, 2025 through March 31, 2025.

Medicare Coverage for Opioid Use Disorder (OUD) Services Furnished by Opioid Treatment Programs (OTPs)

For CY 2025, CMS proposes several modifications to the policies governing Medicare coverage and payment for OUD treatment services furnished by OTPs:

- Proposal to Allow Periodic Assessments to be Furnished via Audio-only Telecommunications on a Permanent Basis

- CMS proposes to allow OTPs to furnish periodic assessments using audio-only communications technology when video is not available on a permanent basis beginning January 1, 2025.

- Proposal to Allow OTPs to Use Audio-Visual Telecommunications for Initiation of Treatment with Methadone

- CMS proposes to allow the OTP intake add-on code (HCPCS code G2076) to be furnished via two-way audio video communications technology when billed for the initiation of treatment with methadone, to the extent that the use of audio-video telecommunications technology to initiate treatment with methadone is authorized by DEA and SAMHSA at the time the service is furnished.

- CMS does not propose to extend the flexibility to allow the use of audio-only telecommunications for intake activities related to initiation of treatment with methadone.

Impact on Health Equity and Patient Access

CMS issues a RFI on Community Health Integration (CHI) services, Principal Illness Navigation (PIN) services, and Social Determinants of Health (SDOH) Risk Assessment to engage interested parties on additional policy refinements for CMS to consider in future rulemaking.

- CMS requests information on:

- Other factors to consider, such as other types of auxiliary personnel (including clinical social workers) and other certification and/or training requirements that are not adequately captured in current coding and payment for these services,

- How to improve utilization in rural areas, and

- How these codes are being furnished in conjunction with community-based organizations.

Other notable proposals from the CY 2025 PFS proposed rule include:

- Coding and reimbursement for caregiver training for direct care services and supports

- Coding and reimbursement changes to Advanced Primary Care Services, including Principal Care Management, Transitional Care Management, and Chronic Care Management

- Coding and reimbursement for an Atherosclerotic Cardiovascular Disease (ASCVD) risk assessment service and risk management services

- Broadening the applicability of the transfer of care modifiers for global surgical packages

- Payment for digital mental health treatment devices furnished incident to or integral to professional behavioral health services

- Payment for dental services inextricably linked to specific coverage services

- Conditions for Certification and Conditions for Coverage for RHCs and FQHCs

- Electronic prescribing of controlled substances for a covered Part D drug under a Prescription Drug Plan or an MA-PD plan

- Medicare Parts A and B overpayment provisions

ADVI will continue monitoring developments and the next steps. This is a delayed release. ADVI Instant content is distributed in real-time for retainer clients. Get in touch to learn more about how we can support your commercialization, market access, and policy needs.