Insights,

Insights,

On November 2, 2023, the Centers for Medicare and Medicaid Services (CMS) issued the 2024 Medicare Physician Fee Schedule (PFS) final rule and other revisions to payment policies under Medicare Part B (link) with an accompanying fact sheet (link).

Notably, this year’s PFS Final Rule finalizes proposals regarding refunds for discarded drug units, changes to telehealth service classifications, and expansion of additional payment for at-home administration for certain Part B preventable vaccine administration services.

Conversion Factor Update and Rate Setting Impact

The final conversion factor for CY 2024 is $32.74, a $1.15 decrease (or 3.45% decrease) from $33.89 in CY 2023.

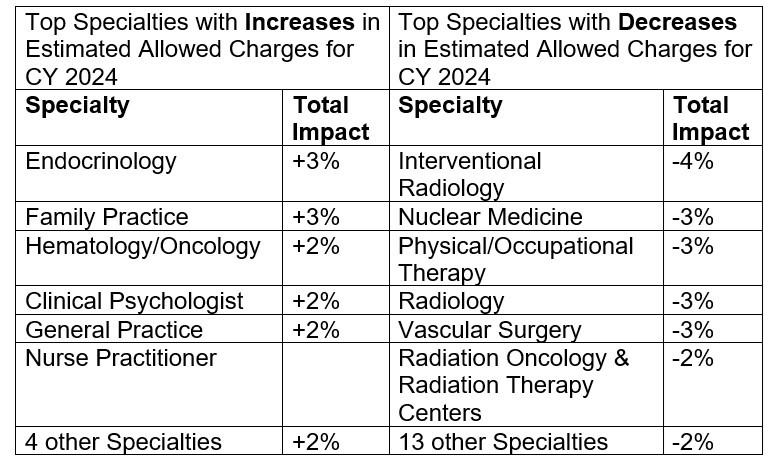

Table 118 includes a breakdown by specialty of estimated payment changes based on the proposed rule. The following is a snapshot of specialties with the greatest increase and decrease in estimated payments.

The final conversion factor accounts for the expiration of a 2.5% increase provided by the Consolidated Appropriations Act (CAA) of 2023, the statutorily required update to the conversion factor of 0.00%, the –2.20% budget neutrality adjustment to account for changes in Relative Value Units, and the 1.25% payment increase as provided by the CAA, 2023.

Telehealth Services

In the CY 2021 PFS final rule, CMS created a new category of telehealth services—Category 3—describing services that are added to the Medicare Telehealth Services List on a temporary basis following the end of the PHE through December 31, 2024. This new category describes services that were added to the Medicare Telehealth Services List during the PHE, for which there is likely to be clinical benefit when furnished via telehealth, but there is not yet sufficient evidence available to consider the services for permanent addition under the Category 1 or Category 2 criteria.

For CY 2024, CMS received 31 requests to add services to the Medicare telehealth list on a permanent basis but finalized as proposed to add or keep them on a Category 3 basis. CMS is finalizing a revised definition of primary care services in a new provision of the Shared Savings Program regulations to include the list of HCPCS and CPT codes specified in § 425.400(c)(1)(vii) along with the following additions:

For CY2024, CMS finalized their proposal to revise their telehealth service designations to two categories instead of the current Categories 1 through 3. CMS finalized instead, creating new “permanent” and “provisional” categories of telehealth services. Current Category 1 and 2 telehealth services would be placed in the “permanent” category while temporary Category 2 or Category 3 telehealth services would be assigned as “provisional.”

CMS also finalized proposals to implement several telehealth provisions of the Consolidated Appropriations Act, 2023 until December 31, 2024, including:

Finally, CMS finalized, starting January 1, 2024, to pay for telehealth services furnished to beneficiaries in their home at the non-facility PFS rate.

Evaluation and Management (E/M) Services

In the CY 2021 PFS final rule CMS created an add-on code for complex E/M visits, G2211, to help account for additional resources required for primary care related to a patient’s single, serious or complex condition. Certain stakeholders were concerned about the budget neutrality adjustment required if G2211 were to be implemented and the potential redistributive impact on PFS payment broadly and in the Consolidated Appropriations Act of 2021, Congress prohibited CMS from paying services under G2211 before January 1, 2024.

With the moratorium on payment for G2211 set to expire on December 31, 2023, CMS is finalizing changing the status of HCPCS code G2211 to make it separately payable by assigning it an “active” status indicator, effective January 1, 2024, as proposed. With respect to the concern that a physician or practitioner would not perform a preventive service on the same day as an O/O E/M visit merely to avoid the policy to not pay G2211 when the O/O E/M visit is reported with modifier – 25, CMS intends to monitor the utilization of this code and continue engagement with interested parties as this policy is implemented.

Part B Drug related proposals

Requiring Manufacturers of Certain Single-Dose Container or Single-Use Package Drugs to Provide Refunds With Respect to Discarded Amounts (“wastage”)

CMS will issue an initial refund report to manufacturers by December 31, 2024, which will include all quarters of calendar year 2023. An initial refund report will be issued by December 31, 2023, and will include information based claims data from 2023 Q1 and Q2. In the future, CMS intends to issue refund reports around the same time as Part B and Part D inflation rebate reports. Starting in 2025, CMS will issue refund reports for the previous calendar year by the end of September. Refund reports will include data for 8 quarters, 4 quarters from the previous year and 4 quarters from 2 calendar years prior. Starting in September 2025, reports will include the total number of units of billing and the payment code of the drug as well as discarded units during the previous calendar year.

The finalized payment deadline for manufacturers is 2 calendar months after the report is issued, allowing time for review and dispute. When there is a dispute, the manufacturer would have 30 days to pay the refund after the dispute is resolved.

CMS finalized that the refund amount owed by a manufacturer is the amount equal to the estimated amount by which:

If the refund calculation from the above formula is a negative number, CMS finalized that the amount will be netted out of any refund owed for other updated quarters or new quarters.

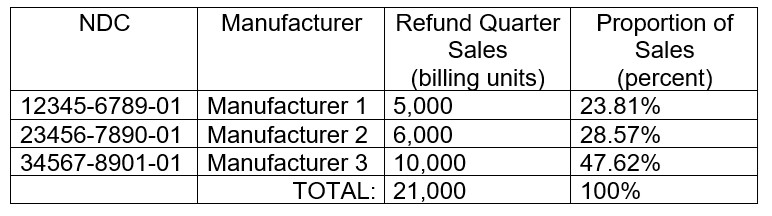

If a drug or biological has multiple manufacturers, the financial responsibility for the refund is finalized to be split by dividing the sum of the individual manufacturer’s billing units sold during the refund quarter for all the manufacturer’s NDCs assigned to the billing and payment code by the sum of all manufacturers’ billing units sold during the refund quarter for all NDCs of the refundable drug assigned to the billing and payment code – all referenced in ASP data submissions.

Multiple Manufacturers Example (Table 21 in final rule):

Finalized Changes for Low Dose Drugs:

Provisions from the Inflation Reduction Act Relating to Drugs and Biologicals Payable Under Medicare Part B (§§ 410.152, 414.902, 414.904, 489.30)

CMS finalized limiting payment for single source drugs or biologicals to WAC +3% during an initial period when ASP data is not available. Similarly, CMS also finalized that for new biosimilars furnished on after July 1, 2024, during the initial period when ASP data is not available, payment will be limited to the lesser of:

Limitations on Monthly Coinsurance and Adjustments to Supplier Payment Under Medicare Part B for Insulin Furnished Through Durable Medical Equipment

CMS finalized codifying new statutory monthly coinsurance limits of $35 for a 1-month supply and $105 for a 3-month supply for insulin given through covered DME.

Request for Information (RFI): Drugs and Biologicals which are Not Usually Self-Administered by the Patient, and Complex Drug Administration Coding

In the proposed rule, CMS solicited comments on updating the self-administered drug list and looking at non-chemotherapeutic complex drug administration payment inadequacy. CMS received comments asking CMS to provide additional guidance clarifying the conditions under which infusion drugs can be considered complex and may be appropriately reported using the chemotherapy administration CPT codes 96401-96549. CMS also received comments expressing concerns about inconsistent MAC guidance. CMS expressed appreciation for commenters’ concerns.

Quality Payment Program (QPP)

CMS proposed several changes starting January 1, 2024, related to the QPP. In the final rule, CMS finalizes:

Clinical Laboratory Fee Schedule (CLFS)

Updates to Protecting Access to Medicare Act (PAMA) Reporting

In accordance with section 4114 of the Consolidated Appropriations Act (CAA) of 2023, CMS finalized as proposed to modify the next PAMA data collection period to run from January 1, 2024, through March 31, 2024, with the next private payor rate-based CLFS update for these tests set to go into effect on January 1, 2025, instead of January 1, 2024.

Additionally, CMS finalized as proposed to change requirements for the phase-in of payment reductions to reflect the amendments in the CAA of 2023, specifically § 414.507(d) to indicate that for CY 2023, payment may not be reduced by more than 0.0% as compared to the amount established for CY 2022, and for CYs 2024 through 2026, payment may not be reduced by more than 15%, as compared to the amount established in the prior year.

Further, CMS finalized as proposed to assess the impact of delayed reporting and subsequent implementation of updated CLFS rates by calculating weighted medians of private payor rates based on new data and comparing the revised rates to the current rates. With respect to data reported in the 2017 data collection period, CMS estimates that 191 tests may be subject to the full 15% phase-in reduction in CY 2024.

Medicare Coverage for Opioid Use Disorder (OUD) Services Furnished by Opioid Treatment Programs (OTPs)

CMS finalized to extend existing flexibilities through the end of 2024 for periodic assessments that are carried out via audio-only telecommunications. CMS will allow OTPs to bill Medicare under the Part B OTP benefit for furnishing periodic assessments via audio-only telecommunications when video is not available to the beneficiary, to the extent that use of audio-only communications technology is permitted under the applicable SAMHSA and DEA requirements at the time the service is furnished, and all other applicable requirements are met. CMS believes extending this flexibility by an additional year (through CY 2024) may promote continued beneficiary access to these services by minimizing potential disruptions to services following the end of the COVID-19 PHE. This extension will also better align telehealth flexibilities for OTPs with telehealth flexibilities authorized for certain other settings under the CAA, 2023.

Impact on Health Equity and Patient Access

CMS finalized to provide separate payment for three new services: Community Health Integration services, Principal Illness Navigation services, and the Social Determinants of Health (SDOH) Risk Assessment. Community Health Integration services (new codes G0019 and G0022) are to address health-related social needs that impact a patient’s medical problems. Principal Illness Navigation services (new codes G0023 and G0024) are to connect Medicare beneficiaries with high-risk diagnoses (such as cancer) to appropriate clinical and social support resources.

The SDOH Risk Assessment service (new code G0136) provides payment for the administration of a SDOH risk assessment tool and the documentation of ICD-10-CM codes Z55-Z65 in a patient’s medical record. CMS finalized to add the SDOH Risk Assessment as an optional element to Annual Wellness Visits (AWVs) with an additional payment, and to provide payment for SDOH Risk Assessments performed on the same day as an E/M visit.

Medicare Part B Payment for Preventative Vaccine Administration Services

Starting in June 2021, CMS provided additional payments for in-home COVID-19 vaccine administration for patients who have difficulty leaving their home to receive the vaccine or are difficult to reach due to disability or socioeconomic and geographic barriers. Starting January 1, 2024, CMS finalized to maintain this additional payment and expand this payment policy to at-home administration of the pneumococcal, influenza, and hepatitis B vaccines (all included in the Part B preventative vaccine benefit). The additional payment rate for in home vaccine administration services is the payment rate established on January 1, 2022 ($35.50) adjusted annually by the Medicare Economic Index.

ADVI will continue monitoring developments and the next steps. This is a delayed release. ADVI Instant content is distributed in real-time for retainer clients. Get in touch to learn more about how we can support your commercialization, market access, and policy needs.

Head of Policy, Research, and Analysis