Draft Guidance on IPAY 2027 Negotiation and 2026/2027 MFP Effectuation

On May 3, 2024, CMS issued draft guidance on the Medicare Drug Price Negotiation Program for IPAY 2027 and Manufacturer Effectuation of the Maximum Fair Price in 2026 and 2027 (link).

This draft guidance revises previous guidance based on “lessons learned to date” from the negotiation process, and additional adjustments may be made to the final guidance to reflect experiences from the ongoing and overlapping IPAY 2026 negotiation period. In addition to revisions, this guidance introduces new details on MFP effectuation, including the use of a Medicare Transaction Facilitator (MTF), 340B deduplication and MFP refund amounts.

CMS is soliciting comments on the draft guidance which are due July 2, 2024. ADVI will provide an in-depth analysis of the guidance with retainer clients in the near term; please reach out with questions in the meantime. Below is an overview of the topline highlights.

Implementation of the MFP

Medicare Transaction Facilitator

- To facilitate the exchange of data and payment between pharmaceutical supply chain entities, CMS will engage a Medicare Transaction Facilitator (MTF) whose primary functions will be to 1) Collect and send claim-level data to Primary Manufacturers (herein referred to as manufacturers) and 2) Receive payment information from manufacturers.

- Manufacturer participation in the MTF is mandatory, but CMS expects and allows manufacturers to engage a third party to perform the operations required.

- After Part D sponsors send claims as Prescription Drug Event (PDE) records to CMS’s Drug Data Processing System, certain claim data will be sent to the MTF, which will process and transmit to manufacturers.

- Claims sent to MTF will have been “dual verified” for MFP-eligibility – once by Part D plan sponsors before sending the claim as a PDE record, and again by CMS’s Drug Data Processing System.

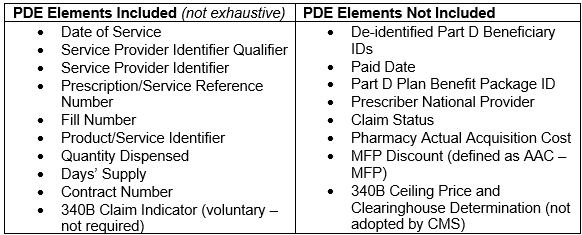

- The claims information that the MTF will send contains data elements to help manufacturers make the MFP available as required by statute.

- Notably, the data elements transmitted by the MTF include some, but not all, elements requested by industry.

- The claims information will also include MTF-generated data elements to help identify records and dates, as well as WAC, MFP, a Standard Default Refund Amount (SDRA, defined as WAC minus MFP), and whether the Dispensing Entity has opted into MTF payment facilitation, but will not include 340B Ceiling Price or a mandatory 340B claim indicator.

- Standard Default Refund Amount (SDRA)

- Manufacturers may make the MFP available prospectively at the time of acquisition or retroactively through a refund.

- Manufacturers must detail how and through what mechanism(s) it will make the MFP available in plans submitted to CMS.

- The MTF will calculate a SDRA equal to WAC minus MFP, instead of a refund amount based on actual acquisition cost.

- If manufacturers and dispensing entities agree to use the SDRA as a “reasonable proxy,” CMS will consider that refund amount sufficient to fulfill the MFP availability obligation.

- CMS notes that manufacturers are ultimately responsible for providing the appropriate amount to make MFP available.

- Manufacturers would have to provide for a larger refund for dispensing entities that acquire the product above WAC.

- ADVI Note: The SDRA may result in overpayment of the MFP refund if a pharmacy’s actual acquisition cost is below WAC.

- 340B Nonduplication

- Per the statute, manufacturers are required to provide access to the MFP to 340B covered entities in a nonduplicated amount to the 340B ceiling price if the MFP is lower than the 340B ceiling price for the selected drug. Manufacturers are not required to provide access to the MFP if the 340B ceiling price is lower than the MFP.

- CMS assumes no responsibility for deduplicating 340B and MFP discounts and declined to implement a mandatory 340B/non-340B claim modifier.

- Instead, manufacturers are responsible for identifying 340B eligible claims and whether they require an MFP refund using the claims-level data provided by the MTF.

- The claims-level data includes a voluntary modifier to identify 340B claims.

- Manufacturers can decline to pay MFP refunds if the claim should be excluded based on the 340B price being lower than the MFP, but documentation will be required

- If the MFP was made available prospectively and the 340B price is lower than MFP, manufacturers would have to provide the difference between MFP and 340B price.

- ADVI Note: Manufacturers should plan to comment on whether the proposed data elements that will be provided by the MTF are sufficient to determine 340B obligations.

- CMS “will continue to explore the feasibility of incorporating 340B-related transactional data” into the MTF process.

- “14-day prompt MFP payment window” – within 14 calendar days of receiving claims information from the MTF, manufacturers must:

- Ensure the dispensing entity receives reimbursement in an amount that provides access to the MFP, and

- Return payment-related data, including: how the MFP was made available on each claim (i.e., prospectively or retrospectively); the amount paid (e.g., SDRA, amount other than SDRA, or no refund) and justification for non-payment and documentation for any payment amount other than the SDRA.Upon CMS’ request, manufacturers must provide evidence of MFP refund payments, which could include ACH transfers, wholesaler chargebacks, e-vouchers, etc.

- CMS is considering shortening the window for Part D plan sponsors to submit PDE from within 30 days to within 7 days, and is determining how frequently the MTF should send claims-level data to manufacturers (e.g., daily, biweekly).

- CMS is considering how to address claim adjustments and reversals, and seeking feedback on whether a timeframe should be set, should overpayments be considered offsets to future claims, etc.

- MTF Payment Facilitation Options

- CMS received comments on potential challenges in making the MFP available to pharmacies given their current lack of direct relationship with manufacturers.

- To address this concern, CMS seeks comments on two payment facilitation options, both of which would be voluntary for dispensing entities and manufacturers:

- Transmittal of Banking Information Only: The MTF would collect banking information from dispensing entities and provide it to manufacturers so that they would have the information required to transmit payment. This approach requires the manufacturer to render a high-volume of transactions (CMS notes there are ~60,000 community pharmacies and other dispensing entities).

- Pass-through of MFP Refunds: The MTF would collect banking information from dispensing entities as well as aggregated refund amounts from manufacturers and would transmit payment to the dispensing entities on behalf of manufacturers.CMS would bear the costs of operationalization of this MTF function, and the MTF would retain payment records.

- MFP Effectuation Plans

- Manufacturers must submit to CMS plans on how they will make the MFP available (either through prospective sales at or below the MFP, retrospective rebates, or a combination).

- Though IPAY 2026 guidance originally set MFP Plan due dates for December 2, 2025, CMS is moving up this deadline and will require manufacturers to submit plans no later than June 1, 2025.

- For IPAY 2027, plans will be due June 1, 2026.

- CMS will conduct risk assessments of each submission, and plans with greater risk of failing to make the MFP available will be subject to increased scrutiny through monitoring and oversight.

- Among other items, manufacturers must include in their plans:

- How the 14-day deadline will be met

- Types of documentation kept for compliance purposes

- Policies and procedures for determining methodology used to calculate the amount of MFP refunds for each dispensing entity

- Whether it will participate in MTF payment facilitation

- A general plan for contracting and reimbursing dispensing entities

- Recordkeeping and reporting (note: manufacturers must keep records relating to MFP sales for ten years)

- CMS notes that individual dispensing entities may choose how they are reimbursed, and manufacturers are expected to work with them to ensure the MFP is made available.

- Redacted plans will be published on the IRA website and CMS must be notified 90 days in advance of any changes, with limited exceptions.

- Complaints and Disputes

- CMS will set up an intake system for complaints and disputes.

- Disputes will include issues raised by manufacturers and dispensing entities related to technical aspects of the MTF process, e.g., claims potentially requiring an MFP refund.

- Complaints will include issues raised by manufacturers and dispensing entities, as well as the general public, on other issues, e.g., reports of MFP not being made available.

- Part D Formulary Inclusion of Selected Drugs

- CMS notes it does not have sufficient information to determine whether changes to formulary inclusion policies from IPAY 2026 guidance is warranted, and as such will not implement explicit tier placement or utilization management requirements that apply across selected drugs in all formularies for IPAY 2027.

- CMS will continue to monitor compliance and may address further.

- CMS also notes that all dosage forms and strengths of selected drugs must be on formulary.

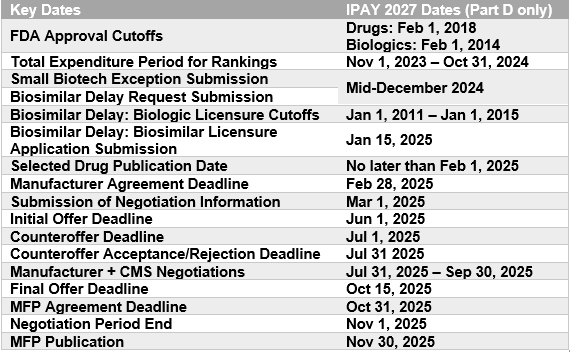

- Selection

- CMS made few substantive changes to the process of selecting drugs for negotiation.

- Low-Spend Medicare Drug Exclusion: CMS will apportion Part B expenditures for drugs that map to the same HCPCS based on the ratio of reported sales volume of a drug compared to all drugs.

- Deadline to apply for IPAY 2027 Small Biotech Exception and Initial Biosimilar Delay: “mid-December 2024.”

- Small Biotech Exception and Acquisitions: CMS will evaluate whether Submitting Manufacturers were acquired before January 1, 2025.

- Public Submissions

- CMS notes it intends to improve the public submission process and may group questions by category of respondent (e.g., manufacturer input, patient or caregiver experience, clinical experience, health research) to align information with a respondent’s area of expertise

- CMS notes that despite groupings, stakeholders can answer any question.

- Manufacturers Submissions

- CMS is requiring several new data elements be submitted by manufacturers, including drug-level data on samples, labeler codes, private labeler distributors, units per package.

- Part D Net Price

- CMS will require a new data element of Manufacturer net Medicare Part D price, which would include “specific data to which the manufacturer has access including coverage gap discounts and other supply chain concessions (e.g., wholesale discounts) not reflected in the sum of the plan-specific enrollment weighted amounts calculation, and utilization that may differ from the PDE data.”

- CMS made changes or revised definitions of some submission elements, which clarified the following:

- Transfer prices should not be included in current unit costs of production.

- R&D pre-clinical costs should be limited to FDA-approved indications; CMS adds a new category to capture R&D related to failed and abandoned products, non-approved indications

- Coupons should be excluded from US commercial average net unit price – net of patient assistance programs, but not US commercial average net unit price.

- Off-label use means a use not approved by the FDA but “is included in nationally recognized, evidence-based guidelines and listed in CMS-recognized Part D compendia.”

- Therapeutic advance means a substantial improvement in outcomes, either compared to a therapeutic alternative or overall for the condition or disease if no therapeutic alternative exists.

- Patient Engagement Opportunities

- CMS is looking to improve on the IPAY 2026 Patient-Focused Listening Sessions in its proposed IPAY 2027 Patient Focused Events, and is seeking feedback on format. Proposed changes include:

- A discussion format where CMS may ask clarifying questions (vs. listen-only)

- Round table sessions on broader topics with a mix of speaker types (e.g., patients, providers, health data experts)

- Focus groups on target topics with one speaker type

- MFP Offers

- CMS’s starting point for initial offers for IPAY 2027 will be based on a therapeutic alternative’s Net Part D Plan Payment and Beneficiary Liability and/or the ASP, or its MFP, if applicable.

- Net Part D Plan Payment and Beneficiary Liability is defined as the Part D total gross covered drug cost net of DIR and Coverage Gap Discount Payments.

- Note: in IPAY 2026, the starting point price was the Part D price net of all price concessions in DIR.

- Timeline

- CMS acknowledges that the IPAY 2027 negotiation period is one month shorter than the IPAY 2026 negotiation period and is accordingly making timeline adjustments.

- For information on the ceiling price and calculation of a single MFP:

- CMS will provide within 45 days (instead of 60 days),

- Manufacturers may respond with suggestions of error within 21 days (instead of 30 days), and

- CMS will respond, if feasible, within 21 days (instead of 30 days).

- For negotiation meetings:

- CMS acknowledges it must hold more meetings in less time (15 drugs vs. 10, in 3 months vs. 4), and may reduce the number of meetings for IPAY 2027 or replace meeting(s) with an additional written offer opportunity.

ADVI will continue monitoring developments and the next steps. This is a delayed release. ADVI Instant content is distributed in real-time for retainer clients. Get in touch to learn more about how we can support your commercialization, market access, and policy needs.