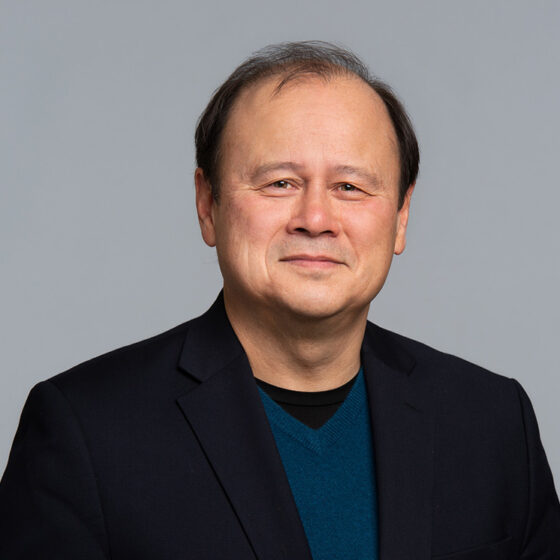

Farooq Tirmizi

Advisor, Financial Services

Farooq Tirmizi

Advisor, Financial Services

“When you’re working on a tight transaction deadline on multiple workstreams, you want an advisor who can do the depth of work that produces a 60-page deck, but can get you up to speed to the point where you can explain to your investment committee in five minutes why that regulatory / reimbursement risk will or won’t kill the deal’s economics. That’s what ADVI does.”

We help clients translate how risk and opportunity factor into decisions on investment and short – and long-term business goals – whether your interest is for a product or service or for the whole company.

Our cross-functional team of clinicians, industry veterans, operators, policymakers, and regulators approach healthcare due diligence as we do any other work – with a deep understanding of the issues, knowledge drawn from experience, and backed by data from our ADVI SAVEs vertical. We also operate an incubator ADVIlab for small companies, helping entrepreneurs and investors across private equity and venture capital with:

Changes in reimbursement or coverage policies, as well as regulatory actions, materially impact the value of investment targets. Our analyses incorporate direct input from ADVI Advisors in the specific policies that will affect the short- and long-term value of your potential product or company acquisition.

Up Close is our due diligence product line consisting of rapid commercial diligence assessments, snap reimbursement analysis, key market segmentation or trend analysis, legislative scoring, ICER HTA analysis, or strategic planning for new investment (product or company).

Our sophisticated financial models to determine the likely economic value of your acquisition are built by experts in forecasting, economics, and valuation and informed by expectations of changes in policy and regulation.

Connect with our team leader:

Senior Advisor